Kaizen in Everything. But Why?

“The only true test of intelligence is if you get what you want out of life.” – Naval Ravikant

The race to keep up with the Joneses is alive and well. If you’re a sports fan or coach, you’ll have been hit in the face by ads for sports tech and wearable technology everywhere you look in 2022. Now while I don’t discount the value of such technology, I do believe that people ought to think critically before investing in it.

I have seen great results in my own training and in my coaching, which have undoubtedly been assisted by the use of the phenomenal software available from Output, Whoop and Statsports. But before I invest in any of these products or services, I like to ask myself a number of questions first. This helps me to evaluate my need for further investment, identify the gaps that these tools will help to fill and address any other issues which may need more urgent attention.

I ask myself

By asking myself this series of questions, I attempt to gather my thoughts around the topic, and decide whether investing at this moment in time is the right decision. To reference Daniel Kahneman’s “Thinking, Fast and Slow”, itt allows me to use my “System 2” thought-pattern, which is more logical and deliberative, rather than my illogical and impulsive “System 1”.

You see marketing and advertising play to our “System 1” patterns of thought. They make use feel something and then attempt to influence us into making quick and impulsive choices. This is how you end up with a car full of groceries you don’t need, when you go shopping on an empty stomach. It is also how that wardrobe of yours has become fuller and fuller, yet many of its contents are still not being worn for months on end.

They pressurise us into making the choices that they want us to, by making us feel like we’re missing out by not investing. Much of the time, we are more influenced to invest by a fear of missing out or losing, rather than our aspirations towards winning and/or improvement.

So, by deliberately asking myself these questions, it affords me to condense my thoughts, analyse what the true problem is and then decide whether my “System 1” thought-pattern was correct in this case. So how does that process usually go?

This is the most important question, which is why it comes first. Often, when we see a shiny new tool, we create a problem in our heads for it to solve. So if the problem was not a problem before you were presented with this new technology, then it probably isn’t a problem at all. If you’ve identified the problem prior to discovering this new tool, then move onto question number 2.

This is an easy one to ask yourself, but it does force you to think a little outside the box to come up with potential solutions. For any problem there will be multiple solutions. So, when you’re faced with a problem, make sure you explore every available option before deciding upon one. It may be a very costly decision to forgo this stage of the process.

After you’ve got all of your options on paper, it’s important to assess which of the options will be the most time-efficient. In reality, this is the biggest benefit of investing in sports tech in the first place. It makes our lives easier and gives you more time to focus on other things. After you know what the time-cost will be, you can measure that up against the financial cost and see if investing would still be worth it.

Data is great. But it’s only great if it’s used well. There is no reason to compile data for data’s sake. More does not always equal better. Will you actually use the data to inform your process? Will it make a big difference in the long-term? Or are you just doing it because it sounds scientific, fancy and like what the best of the best are doing?

There’s another thing that the best of the best are doing too, and that’s doing the basics better than anybody else. Make sure you’re doing that first, before you go adding strings to your bow.

To follow on from the above, the data will only be useful if it affords you more time and makes your job easier. If it’s going to complicate things further, then it’s probably better that you pass on the investment and focus on other areas.

The final question and the one that the potential seller cares the most about, is do you currently have enough excess income, that you can invest in the product or service on the table. This question does not just refer to your bank balance. It’s important to ask yourself, what will the return on investment be long-term? Is now the right time to be investing this sum of money on this product, or are there more important things that need to be addressed first?

Hopefully, following this process will help you to decipher whether you need to get that activity tracker, heart rate monitor or GPS unit, or whether you just want it. Often, what our brain tells us in the moment, is not the true answer to our problems.

Think before you purchase.

Assess before you invest.

“The only true test of intelligence is if you get what you want out of life.” – Naval Ravikant

So, we can see that when it comes to our training, a certain volume of work when paired with adequate recovery is positive for our development, but if that same intensity of work is mismanaged and spiked, then the same exercise intensity can be toxic to the athlete.

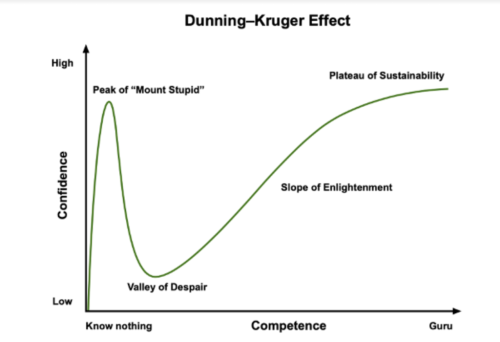

Unfortunately, it takes a fall from the peak of mount stupid, on top of the Dunning-Kruger curve, for many of these lessons to land home.

Here to help you achieve your health and performance goals.

At Petey Performance, I’ll assist you every step of the way. What’s stopping you?

Take ownership today.

© 2021 All Rights Reserved

Subscribe to Petey Performance and get updates on new posts plus more exlusive content.